Taking the spot of the best bank in the world for two years in a row as rated by Lafferty Group is indeed a huge achievement. As if that’s not enough, Capitec Bank is also the second-largest retail back in the whole of South Africa. Knowing how the bank has simplified the banking experience for their customers, you would see the reason why up to 120,000 people switch banks or open a fresh account with Capitec Bank every month. Yes, sending money from your Capitec account to another account is so easy. You don’t even have to visit a branch in order to do that. By the time you are done reading this short post, you should know how to transfer money using the Capitec Cash Send feature on the bank app and whether or not it is possible to reverse a transfer.

How Capitec Cash Send Works

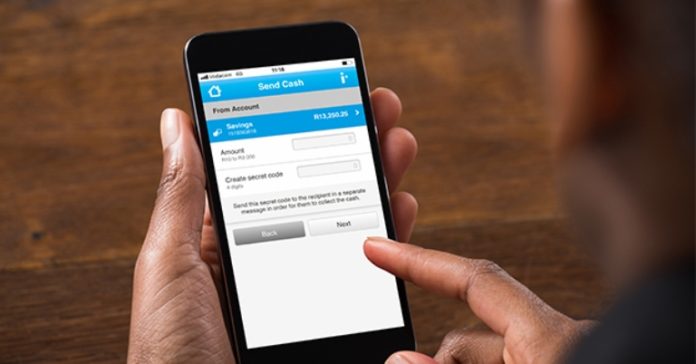

Capitec Cash Send is a method of transfer used by Capitec Bank to make the transfer of money from one Capitec account to another easier for all their customers. With your mobile phone and at your convenience, you can transfer money by either using the app or USSD code. To get the Capitec app, you can choose to download it from Google Play Store (for Android phone users) or App Store (for iPhone users) on your phone or visit any Capitec bank branch around you.

It is pertinent to note that before you are allowed to make use of the app to transfer money, you have to have an account with Capitec Bank and activate the mobile app. To open a Capitec Bank account, you have to visit any branch around you. The only document you will need for this procedure is a document of identification.

After opening a Capitec account, if you are finding it difficult to download the app, here is how to go about it:

- Visit any Capitec bank branch around you

- Verify your phone number and email address at the bank

- An SMS that contains a link to download the Capitec bank app will be sent to you

- Click on the link to download the app

- Install and follow the prompts to activate the mobile application and get a remote pin

Quick Solution to Unverified Email Address Issues

If you already downloaded the app from the play store or app store and your email address is not verified, you don’t have to reinstall the application. Here is how to go about it.

- Open the installed app

- Tap on the menu bar at the top right corner of the home screen.

- Tap on My Profile

- Follow the instructions you see on your screen to complete your email address application

After activating your mobile app, you can now send money from one Capitec bank account to another or any other bank account.

How to Transfer Money From Your Capitec Account

If you have friends and family who also have accounts with Capitec bank and you wish to use the Capitec Cash Send to transfer money, Capitec bank has made the process very easy and secured. Here is what you do:

- Open your Capitec bank mobile application

- Tap on Transact

- Click on Cash Send

- Input your remote pin

- Tap on the button on your screen

- Tap on the account you want to debit

- Input the amount of money you want to transfer

- Enter a four-digit code (keep this code private, as it will be used to accept the money by the recipient)

- Tap on Next

- Carefully read the terms and conditions

- Tap on the Accept box

- If you are sure of all the information you provided above, tap Yes to confirm your transaction

- You will receive an SMS that contains a reference number which you should send to the recipient

- Also, send the four-digit code in step 8 to the recipient

You Don’t Have to Use the Capitec Bank App to Cash Send

If you do not want to use the mobile banking app, you can still transfer money from your Capitec account using a USSD code. Please note that before using the code, you must have the mobile app and activate it as well. Here is how to use the USSD code to transfer money from your Capitec account:

- Open the phone app on your cell phone

- Dial *120*3279#

- Select 9

- Accept the terms and conditions

- Select 1

- Choose the account you want to debit

- Enter a four-digit code (keep this code private, as it will be used to accept the money by the recipient)

- Input your mobile banking app pin

- Send the reference number and four-digit code to the recipient

Capitec Cash Send is Easy to Use But Not Free

Transferring money from your Capitec account will cost you a token. The exact amount will depend on the amount of money you transfer. To transfer between R40 to R1,000 attracts a fee of R8, while to transfer between R1,010 to R3,000 attracts R16. However, any transfer above R1,000 cannot be done using USSD code, so, if you wish to send above R1,000, you should consider using the mobile banking app.

Transferring Money From Your Capitec Account to Another Bank

The procedures above should not be used if the recipient account is not a Capitec account. Follow the method below to transfer money from your Capitec account to any other bank account.

- Open your Capitec bank mobile app

- Tap on Transfer

- Tap on Payment

- Choose or create a beneficiary account

- Tap on Pay

- Input payment details

- Tap on Immediate Payment

- Input your private remote pin

Note that the transfer limit from a Capitec account to another bank per day is R100,000.

Reversing a Payment on Capitec App

In a situation where you transferred money to the wrong recipient, Capitec Bank cannot be held responsible neither will they reverse the transaction. So, you will have to be very careful when making any transaction. Before confirming any transaction, ensure that all the information you provided is correct. And also avoid sending the reference number and four-digit code to the wrong person.

But, in a situation where your mobile banking app was used without your permission, you can dispute the debit order and demand a reversal, and here is how to go about it:

- Open your Mobile Banking app

- Tap on Transact

- Select Debit Order

- To sign in, input your private remote pin

- Select a particular debit order from your transaction history

- Select a debit order dispute reason

- Tap on Accept

Please note that your Mobile Banking app cannot be used to dispute any debit order from R800 and above. So, if R800 or more was transferred out of your Capitec bank account without your permission, kindly visit any Capitec bank branch around you.

For a 100% Reversal Assurance, Register Your Dispute Within 40 Days After Debit

It is possible for your money to be reversed back to your Capitec bank account in less than 24 hours if you dispute the debit order immediately after it occurs – not more than 40 days after. However, it may be difficult for your debit order dispute to be accepted and your money reversed if the order is registered 40 days or more after the transaction was made.