At the heels of the Covid 19 pandemic which rendered millions of people all around the world jobless, different countries decided to come up with various welfare packages for their citizens to help alleviate the suffering caused by the pandemic. Here, the South African Social Security Agency (SASSA) has been mandated by President Cyril Ramaphosa to distribute an economic support package of R500 billion to unemployed citizens.

Although the registration to benefit from the package is pretty much straightforward, it is not completely out of place for one registering for the SASSA COVID 19 SRD Grant to recieve the error message; IRP5 Registered, which suggests that one is still employed or considered to have an alternative source of income by the system. Here’s a quick guide on all you should know about the error message.

The Meaning of the IRP5 Registered Message

If in the process of your registration you get the IRP5 Registered message, what this means, as stated, is that the system considers you to not be eligible to receive the government grant because you are either employed or have another source of income.

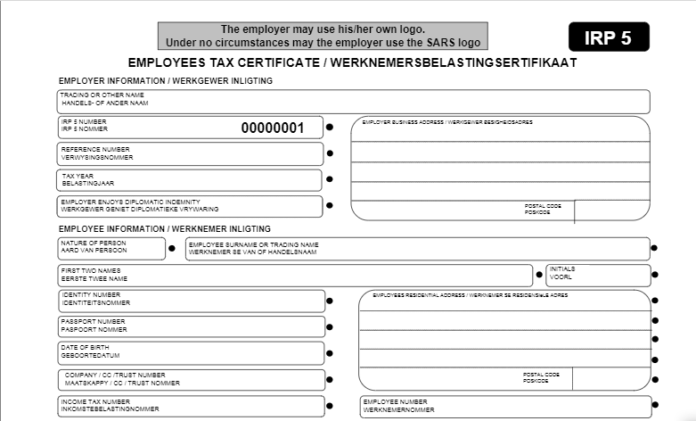

IRP5 is a document that is also referred to as an employee’s tax certificate. It provides information on the employer/employee’s related incomes, as well as taxes and all related deductions at the end of each year. Hence, when the system finds out this information, it shows that one is still employed or has an alternative source of income, resulting in the IRP5 Registered notification.

Once this happens to you and you are out of employment, you may need to put a call through to the South African Revenue Service (SARS) on 0800 00 7277 or contact them via its online portal in order to have your records on their platform updated. Apart from putting a call through, you may be required to do a few paperwork, after which you can appeal to the SASSA for your application to be considered. This, however, may take a while because of the many people who have also appealed.

IRP5 Form – What It Does and Why You Need To Fill It

IRP5 form is a document designed for the employee income tax certificate. It captures the remuneration earned by an employee as well as certain deductions allowed and also employees’ tax deducted within a tax year which usually runs from June to November of the year.

When filled by an employer, the form serves to indicate that one has fulfilled one’s tax obligation for a specified tax year. It details everything from all one has earned in the stated period and also all that has been deducted in taxes. The form comes with various sections such as information about the employer, employee information, tax calculation information, other sources of income, gross remuneration, deductions, and employees tax deductions.

How To Download The IRP5 Form

In spite of the IRP5 Registered message one gets when trying to access the SASSA grant, it is very important for one to register, as it is an indication that one is not only employed, but that one is also paying one’s tax.

At the end of each year, the service opens a tax filing year so that individuals and entities can file their returns either through eFiling or visiting an agent. To determine what one needs to pay in taxes in relation to one’s income details on a specific tax period. The document is submitted by one’s employer.

Employees are also expected to have the IRP5 Form because it becomes very useful when you are filing for your tax returns. If by any chance you file for it without including the IRP5 Form, SARS may later request for it and so it is very important that you have it readily available. Also, since you can get the document on hard copy or online, it is very easy for one to download. To do this, one can simply follow this link and then click on Get Form. This will convert the file and make it available for you to download in PDF format. Using the guide, it can be filled and submitted.

How To Fill and Submit My IRP5 Form Online

It is important to note that the filling and submission of your IRP5 Form is reserved as the duty of one’s employers. You, as an employee, have no right to make any adjustments to the document after it has been submitted. In order to file for the returns, employers can follow the steps below:

- Make sure that all processing for the tax year has been completed

- Check to ensure that all basic company information have been checked and updated.

- All personal details of employees, most especially the mandatory ones should be checked to ensure they have all filled accurately.

- Ensure that the IRP5 codes used for both income and deductions have accurately been entered.

- Check and correct any errors that may ensure as regards the earnings for retirement fund income and non-retirement fund income.

- The medical aid tax credit should also be validated.

- Ensure that all filings have been validated and confirmed.

- After you must have taken note of all errors and have made adjustments, do a quick IRP5 live run and import the live file into e@syfile-Employer.

- Capture any manual tax certificates on e@syfile-Employer.

- You will also need to check employer information on e@syfile-Employer.

- Ensure that you are registered for IRP5 submission on E-filing.

- When all the above steps are done, you will be expected to submit the electronic information to SARS via e-Filing.

- Make a backup of the tax year-end data and store it in a safe location.

Three Different Ways of Submitting The Form

After the form must have been filled, there are different ways that an employer can use to submit the IRP5 form.

1. eFiling

This can be done from your computer by simply visiting and registering for eFiling at www.sarsefiling.co.za. This will give you access to the platform where you will only need to login and submit the document for your employees.

2. Electronically at a SARS Branch

Another way to submit the IRP5 is through electronic means, by visiting any branch of SARS nearest to you with all supporting and relevant documents after you must have booked an appointment. There, you will get agents who will assist you with the submission.

3. At a SARS Branch

An employee can also make a request for a return to be posted to you, and then when it is completed, you can submit it to any SARS branch.

You Can Download Your IRP5 If There Is A Need

Even though as already stated, you cannot make any adjustments to your IRP5, it is still possible for you to download it after it must have been submitted by your employer. However, this may not be a very easy process.

The easiest way that you can get your IRP5 is from your employer, but if that is not available, you can check the portal of your organization if it is made available for easy downloads there. If that is not available or you have already left the company, then the best way in which you can get the document is by simply visiting the nearest SARS office you for advice on the best action to take.