A few years ago, the mere idea of going to a banking hall for any transaction was exhausting. Anything that required visiting a bank branch, whether it is to transfer money, check your account balance, or rectify any issue with your account was a big deal. But with improvements in technology, banking got easier, requiring customers to register a particular number with which they can receive SMS containing their account balance after every transaction.

With further improvement in technology, banks hopped on the opportunity to enhance customer satisfaction. Thus, it became possible for most of their operations to be carried out online and customers could now check their account balances at any time and anywhere. Customers of Standard Bank can check their account balances using various methods from the comfort of their homes.

Various Methods Of Checking Your Standard Bank Account Balance

In order to track your expenses and properly budget your funds, it is necessary to always keep track of your account balance. As a financial institution, Standard Bank understands the importance of making it as easy as possible for customers to access their account balances from anywhere and at any time.

Standard Bank has therefore leveraged technology to provide different methods through which customers can check their account balance. There are several methods to achieve the same result and customers can use any of the available ones that suit their preference. Even customers who are not familiar with tech gadgets do not have to worry about checking their account balance as there are methods put in place to help them do that.

Here is a list of the different methods of checking your standard bank account balance to choose from:

- Online Banking

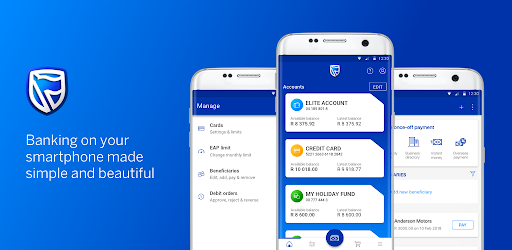

- Standard bank mobile app

- ATM

- Setting up alerts

- Cellphone Banking

- Going to the bank branch

How To Check Your Standard Bank Account Balance Via Online Banking

One of the easiest methods of checking your standard bank account balance is through online banking, however, the major limitation to this method is that it requires that you have either a smartphone, laptop, or desktop with which you can access the internet. It also requires that you have sufficient data to carry out the operation.

Also, this method may not be very easy for those who are not familiar with surfing the net. But, if you have all the necessary requirements and know how to access the internet, then here is how to check your balance via online banking:

- Log in to your online portal.

- You will be welcomed to a dashboard that contains all the accounts linked to your online profile.

- To view your account balance, click on the account you will like to check its balance.

- A page containing your account balance and a summary of your transactions will be displayed on your screen.

How To Check My Standard Bank Account Balance Using The Mobile App

Checking your account balance with the Standard Bank mobile app requires that you download and install the application on your phone, after which you register your account in the app. If you have done this already, you can proceed to check your account balance using the steps below:

- Open the Standard Bank mobile app on your phone.

- Sign in using your password.

- Tap on the Balance icon.

- Your account balance will be displayed on your phone screen almost immediately.

It is important to note that this method is only accessible to smartphone users. Also, it does not attract any charge.

You Can Check Your Account Balance Via Cellphone Banking

The use of cellphone banking makes banking from the comfort of your home a very easy process for both smartphone users and non-smartphone users. Checking your account balance via cellphone banking is not a technical process and can be a great alternative for those who are not familiar with the technology that goes with internet banking. Here is how to check your Standard Bank account balance using cellphone banking:

- Open your phone dialer.

- Dial *120*2345#.

- Select the option to check your account balance and follow the prompts.

How To Check Your Account Balance Via ATM

Another method for checking your Standard Bank account balance is using an Automatic Teller Machine (ATM). The major limitation to this method is that it cannot be done from the comfort of your home. You will have to visit the nearest Standard Bank ATM or any other bank’s ATM; and if there happens to be a queue, then you may need to wait a while.

When it gets to your turn to use the ATM, here is how to check your account balance:

- Insert your card into the machine.

- Enter your card PIN.

- Select the Check Account Balance or Enquiry option and follow the necessary prompts to successfully check your account balance.

You Can Keep Track Of Your Account Balance By Setting Up Alerts

A great way to stay updated on the amount of money in your account is to set up alerts. This will help you to monitor the activities on your account. It notifies you whenever your account is involved in any kind of transaction – whether it is a debit or credit transaction. You will receive an SMS that contains the amount you were debited or credited with and also your account balance.

To set up this notification, you may have to visit the nearest Standard Bank branch and fill a form to provide the mobile number you want your alerts to be sent to. The process of going to the bank may not be easy, but it is a once-off process and will not require you to repeat it again.

You Can Check Your Account Balance At Any Standard Bank Branch

Although this method is gradually becoming outdated as nobody enjoys going to the bank and waiting on long queues just for an account balance. However, if for any reason you still want to visit a branch, request to see a customer service personnel and then tell him or her that you will like to check your account balance. They will ask for your account number and then reveal your account balance to you.

You Can Check Your Standard Bank Account Balance By Calling A Customer Care Agent

Alternatively, you can also check your account balance by calling a Standard Bank customer care agent on 0860 123 000. Once you are connected to an agent, tell him/her your request, and they will ask for your basic information with which they can access your account to check your balance. Always ensure that you provide the appropriate information to them to facilitate the process.