About a couple of years ago, money transfer used to be one of the most difficult things for bank customers. It required you to visit a bank branch and stand in long queues. But with the introduction of mobile banking, cash transfer has gotten easier and ABSA has taken advantage of this to make money transfer even easier. When it comes to banking in South Africa, ABSA has one of the simple and convenient approaches. With the ABSA Cash Send, customers can now transfer money using a method as easy as USSD codes to send cash from one account to another.

What You Need To Know About ABSA Cash Send

ABSA Cash Send makes it easier for customers to send money from their account to another account, and the recipient will receive the money almost immediately without stress. What makes this medium of sending cash even more fascinating is the fact that the recipients do not necessarily have to have an account as they can easily withdraw the money from any ABSA automatic teller machine.

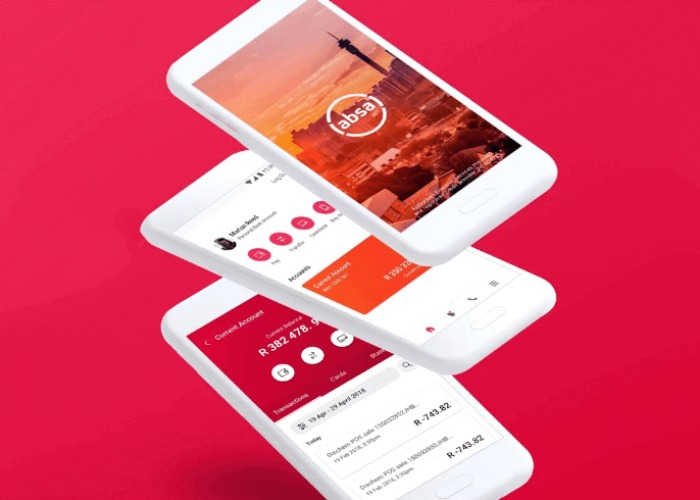

You can access ABSA Cash Send using ABSA Online Banking, ABSA Banking App, Cellphone Banking, and at any ABSA ATM stand. All of these methods save customers the stress and risk of carrying so much cash at a time as they can always withdraw money at any time.

Benefits Of Using ABSA Cash Send

There are so many benefits of using ABSA Cash Send. In case you are not yet convinced about using it, the numerous benefits should convince you. Here are some of the benefits you should know:

- Time-Saving: ABSA Cash Send is the easiest, most convenient, and fastest method to send money from your ABSA account. It also saves you the stress of standing in long, annoying queues.

- Secure: Transferring money digitally saves you the risk of carrying a large amount of money with you to the bank.

- Convenient: With ABSA Cash Send, you can transfer money with ease anywhere and anytime.

- Make cardless cash withdrawals: When you transfer money to yourself, you do not need a card to withdraw it.

ABSA Cash Send also makes staff payment easier, it saves you the stress and risk of carrying huge amounts of money for staff payment.

There Are Different Methods Of Using ABSA Cash Send

ABSA has provided a variety of methods for customers to make use of Cash Send depending on their preference. Before choosing a method of sending money, it is best you get familiar with all the options, then select one based on your preference.

You Can Send Money With Cash Send Using ABSA Online Banking – Express Banking

Sending money via ABSA online banking – Express Banking will require that you have a smartphone and sufficient data. To use this method to send money, follow the steps below;

- Log in to ABSA online banking.

- Tap on the navigation menu at the top of the page and select Cash Send.

- Choose your desired CashSend beneficiary(ies).

- Choose once-off CashSend or CashSend a new beneficiary.

- Select the account you want to debit.

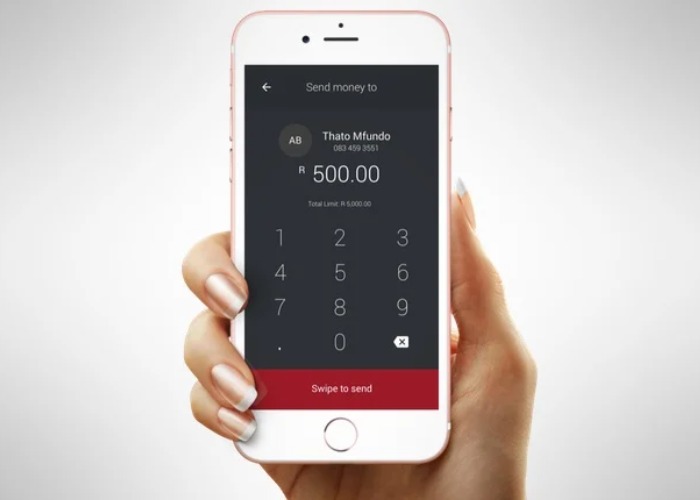

- Enter the amount you want to send.

- Input the recipient’s cell phone number.

- Create a 6-digit code that you will give your recipient to access the money.

- Confirm payment.

Cash Send Can Be Done Using ABSA Online Banking – Full Service

You can also send money using the full online service and here is how to go about it:

- Visit ABSA online and enter your account number PIN and username.

- Select Payment.

- Select Pay and CashSend Payment.

- Choose the account you want to debit.

- Enter the amount you want to send.

- Input the recipient’s number.

- Create a 6-digit number that will be sent to the recipient.

- Confirm payment.

You Can Also Send Money With ABSA Cash Send Using Cellphone Banking

The ABSA cellphone banking method is one of the most convenient methods of using the Cash Send service.

- Dial 120*2272# to log on to mobile phone banking.

- Select Cash Send.

- Select Cash Send Payment.

- Log off.

- Wait until a secure URL is sent to you via SMS.

- Tap on the link to be directed to a page where you will be required to enter the amount you wish to transfer and the recipient’s cell phone number.

- Create a 6-digit code that you will give to the recipient in order for him/her to access the money.

- Confirm payment.

Cash Send using cellphone banking has some limitations. You can only send a minimum of R20 and a maximum of R500 per day.

How Do I Withdraw Money From Cash Send?

Withdrawing money sent to you via ABSA Cash Send is a very easy process. Cash Send does not require the recipient to have an account. To withdraw money sent to you via Cash Send, follow the steps below:

- Go to any available ABSA ATM with the Cash Send option.

- Select Cash Send.

- Select Cash Send Withdrawal.

- Enter the 10-digit code that was sent to your cellphone number via SMS.

- Enter the 6-digit number that was sent to you by the person who made the transfer.

- Immediately after the transfer is confirmed, the ATM will issue the money.

Please note that you must withdraw all the money that was sent to you at onc as part withdrawal is not allowed. In a situation where you don’t receive the 10 digit passcode, the sender may need to call ABSA Cash Send customer care on 0860 111 123.

How Do I Cancel An Unredeemed CashSend?

If you want to cancel a Cash Send sent to a beneficiary, follow the steps below:

- Tap on the menu and select Beneficiaries.

- Click on the CashvSend tab beneath the beneficiaries heading.

- Use the search bar or scroll through the list of beneficiaries to search for the beneficiary whose Cash Send you want to cancel.

- Tap on the history icon next to the beneficiary name to see details on all the transactions you have done with the beneficiary.

- After identifying the Cash Send you would like to cancel, tap on the More button next to it.

- Select Remove CashSend.

To cancel a once-off Cash Send, you have to switch to full ABSA online banking service, and here is how to go about it:

- To change to full ABSA online service, tap on the menu at the top and select Full Service.

- Once you have successfully switched to full service, select Payment, and then open Cash Send.

- Select View Unredeemed Cash Send.

How To Make Transfer From ABSA To Other Banks

To make immediate interbank transfer using your mobile app, follow the steps below:

- Log in to your ABSA Banking App.

- Tap Pay.

- Select Pay New Beneficiary.

- Enter the beneficiary’s name, account details, their preference number, your reference, and payment notification.

- Tap on Next, and proceed to the payment page.

- Fill in the amount you want to transfer.

- Confirm the payment.

- Click Accept and Pay to accept the disclaimer.

- A confirmation will pop up, accept, to finalize payment.